There is a lot of discussion of tax rates in the United States, especially every four years as an election approaches. I remember when I was taking an accounting ethics course at Austin Community College, one student said that our tax structure is not as progressive as it used to be and the teacher quickly agreed with him. He was implying that the rich were not paying their fair share. On the other hand, others talk about the high tax rates on the rich stifling business and growth. I did not intend to argue one way or the other, but just give a summary of the federal income tax in the United States and let readers draw their own conclusions. However, after going through the facts myself, I felt compelled to offer up some observations at the end.

The first tax in the United States was enacted during the civil war (to help with war efforts in the North), but it was repealed after the war was over. If you are reading this and one of your ancestors forgot to file their return, you can assess the 1864 federal income tax return here. It was only only for people with annual incomes above $600, which was a lot back in 1864.

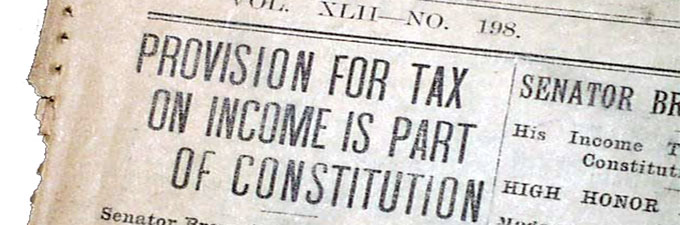

Later on income taxes were ruled as unconstitutional in Pollock v. Farmers’ Loan & Trust Co. Thus, an amendment became necessary in order to enable Congress to levy taxes. The 16th Amendment to the Constitution was passed in 1913. In 1913, taxes for individuals ranged from 1% to 7%. However, most individuals did not pay taxes since most individuals did not make $3000, the amount of the personal exemption. The seven percent bracket was only for those who made over half a million dollars a year, which was a lot of money in 1913.

In 1916 the maximum tax rate went up to 15%, but that was people making over $2 million a year (again a huge of money in 1916).

However, in 1917 with WWI the maximum tax rate escalated to 67% for those making over $2 million a year. It was 65% for incomes over $1 million a year and 50% for those making over $300,000 per year. As you can see rates went up dramatically and affected more people. However, most families still did not make $5000, the amount of personal exemption for that year. So for all practical purposes the income tax was a tax on the rich.

The maximum tax rate went up to 77% in 1918, and then dropped down to 73% the next year. It dropped down to 58% in 1922. It dropped down to 46% in 1924, but the top rate applied to anyone making over $500,000. The next year it dropped down to 25%, but this time it applied to anyone making over $100,000. Granted that was still a whole lot of money in the 1920’s. Families making less than $5000 were not required to file, and that applied to a whole lot of people in 1925. The lowest tax bracket was only 1.5%.

Tax brackets remained pretty much the same from 1925 through 1931.

To Continue: See Great Depression through WWII